Makro i sektorske analize koje vam pomažu u pametnom i utemeljenom donošenju odluka.

Zlato do kraja 2026. može i do 5.000 USD/unc

30.12.2025 12:11

Impresivnih +28% povrata za tržišta u razvoju

29.12.2025 17:31

Rast u 2025. otporan ali neujednačen

26.12.2025 11:05

Produktivnost u regiji raste, ali presporo

14.11.2025 18:22

Filteri

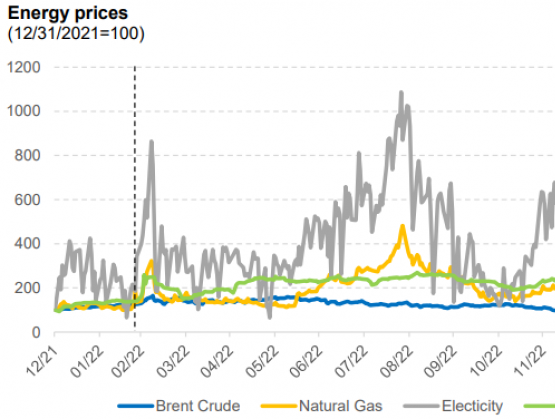

Commodity market - Rocky road for commodities continues

Commodity prices experienced exceptional volatility in 2022, mostly triggered by the breakout of Russia-Ukraine conflict, post-pandemic demand instability and heavy droughts in many economies. High inflation rates in recent periods shed the light on commodity market due to its prompt and undeniable pass-through to price levels causing domino effect on inflation rates.

23.01.2023.

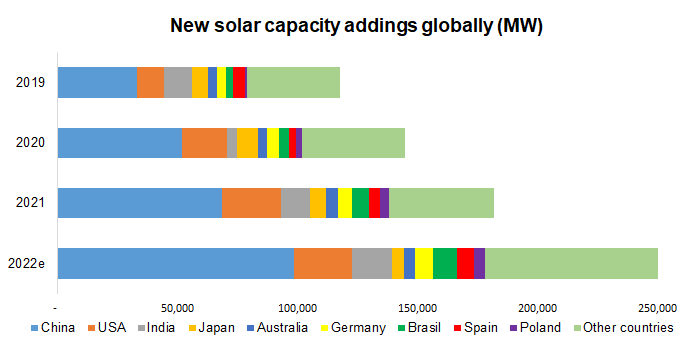

Solar Energy Industry - Green energy transition & prospects for solar industry

Countries in Adria region are on the very end of the list of European countries as per installed capacity. Renewable capacities are increasing with a special note on solar. As compared to 2015, solar recorded 3-digit % growth in most of countries. But still, capacities are far below other countries in Europe despite potential Adria region has.

18.01.2023.

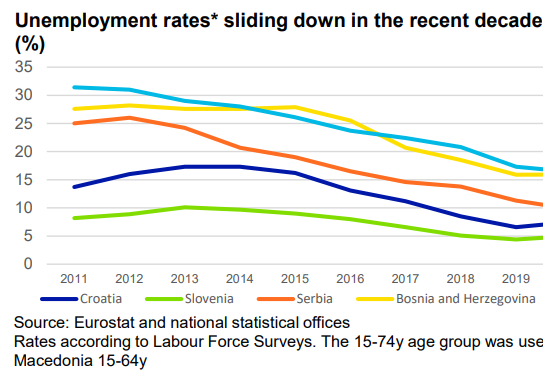

Labour market - Is the glass half empty or half full?

Labour market is strengthening and being one of the key factors behind the 2022 economic firming as well as acting as a limiting factor against counter-inflationary measures. Indeed, the unemployment rates returned toa multi-year downtrend, with Croatia and Slovenia are at or even below the EU average, while the rest of the region hovered around double-digit levels.

16.01.2023.

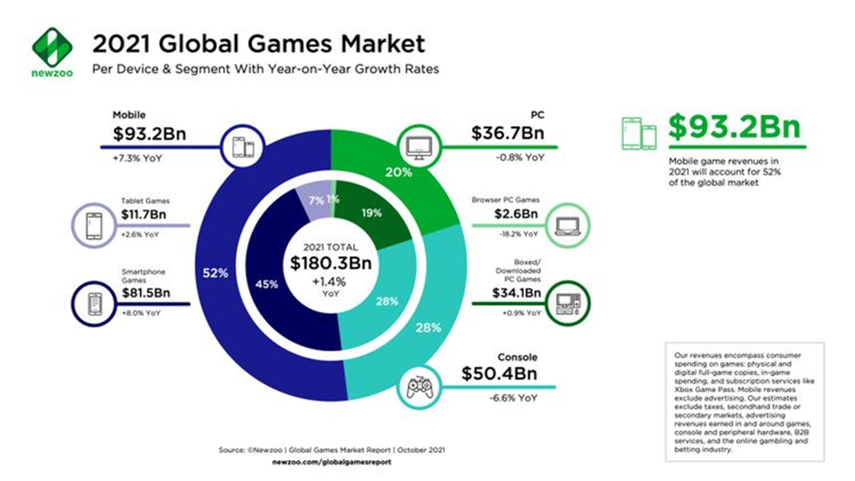

Gaming industry

Average sales growth for the global peers has slowed to 3.5% in 2021, unlike 26.2% average decline in sales for the Adria region companies. Although, a decrease was driven by the large weight of Nanobit as its sales is the highest among the peer group, while both Nordeus and Ekipa 2 displayed sales growth.

04.01.2023.

Fiscal policy - A Wicked Mix of Tax Policies

In 2022, countries in Adria region have seen the best fiscal performance since at least 2019 largely on the back of economic activity rebound after exiting the pandemic limitations. That performance was also driven by a multi-decade high inflation, which in the first step increases the nominal value of tax intake before consumers adjust their spending habits due to higher costs.

19.12.2022.

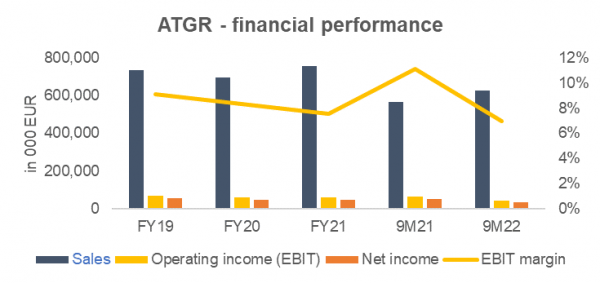

Atlantic group (ATGR) - Coffee Price Kept Them Awake at Night

With the exception of 2020 (for obvious reasons), Atlantic Group is steadily growing its top line. Double-digit inflation and tourism recovery have both contributed to top line increase, primarily in the coffee and beverages segment during the course of this year. On the other hand, input cost inflation outpaced the sales growth and resulted in margin contraction. In absolute terms, the main catalyst comes from the increase in material costs, particularly input costs of raw coffee, followed by the increase of energy costs.

15.12.2022.

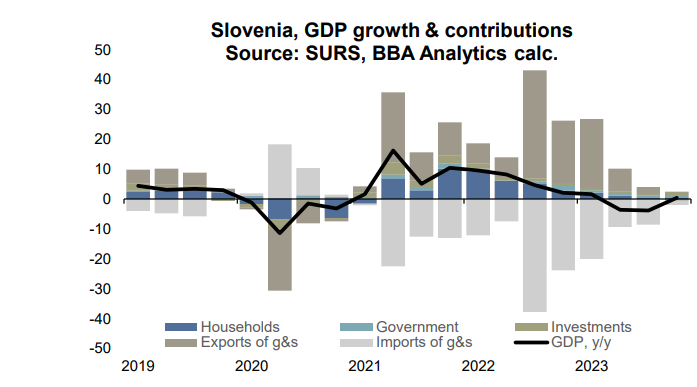

Adria Region Macro Quarterly 1Q 2023 - Economic Winter Blues

Real GDP outcome in 2023 in Adria region is expected to show a mixed picture, after healthy single-digit growth throughout 2022. We forecast a relatively small drop of overall economic activity in Slovenia, a symbolic slip in Croatia and mild growth rates in the non-EU region members.

14.12.2022.

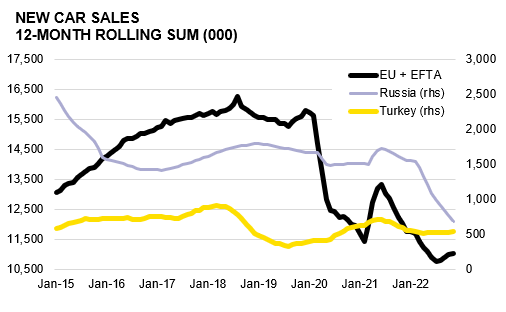

Automotive sector analysis - one piece at a time

In this sectoral analysis we are examining the latest trends and outlook for the automotive industry, concentrating on the Adria region’s key producers and their contribution as well as dependencies. Observing trends for the EU, EFTA and the biggest near-by markets, the figures are displaying bottoming out in car sales. We see two factors dominantly explaining the latest dynamics: a gradual recovery in the global supply chains and tightening, and demand strengthening as a function of economic activity rebound from the pandemic

12.12.2022.